Providing Part D Plans a Record of Supplemental Payer's Payments

The Medicare Part D Prescription Drug Program was enacted on January 1, 2006 as part of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA). The Medicare Part D program was implemented, in part, to help subsidize the cost of the overall prescription drugs of an aging population by ensuring access to affordable drugs.

Part D Sponsors are required to coordinate benefits with State Pharmaceutical Assistance Programs (SPAPs), AIDS Drug Assistance Programs (ADAPs), charities and other providers of prescription drug coverage (such as commercial insurance). If these entities provide coverage supplemental to Part D and participate in the eligibility data exchange with CMS, Part D Plans are required to coordinate benefits for a period not to exceed 36 months from the date of fill for a covered Part D drug.

CMS requires Part D Sponsors to coordinate benefits with supplemental payers when:

- Supplemental payers send electronic eligibility data for Part D eligible beneficiaries that are in their plan to CMS.

- The 4Rx on the claim paid by the supplemental plan matches the 4Rx on the eligibility information the supplemental payer has sent to CMS.

- The Part D Sponsor has paid for the Part D drug and the supplemental payment transaction information (N transaction) can be matched to the Other Health Insurance information on record and the covered Part D Claim.

When coordinating benefits, only supplemental coverage of Part D covered drugs must follow Coordination of Benefits Rules as only Part D covered drugs count towards the beneficiary's TrOOP accumulation. A Part D covered drug is one that is covered by the Part D Plan under the plan's formulary, through a transition period, or via an exception, appeal, or grievance, and must be purchased at a Part D in-network pharmacy (unless the Part D Sponsor has permitted an override for a non-network pharmacy). The drug must meet the CMS definition of a Part D drug.

Coordinating benefits with supplemental payers ensures that the Part D beneficiary's TrOOP is correctly stated, and that supplemental plans that have contributed to the beneficiary's cost share are considered when adjustments are made by the Part D Plan, and when determining refunds based on payment order. This means that if a refund is due, the supplemental payer will be refunded prior to any refund going to the beneficiary.

To effectively coordinate benefits there are processes, rules and requirements for both the Part D Plans and the supplemental payers. The links to the right on this page provide documentation specific to Part D Plans.

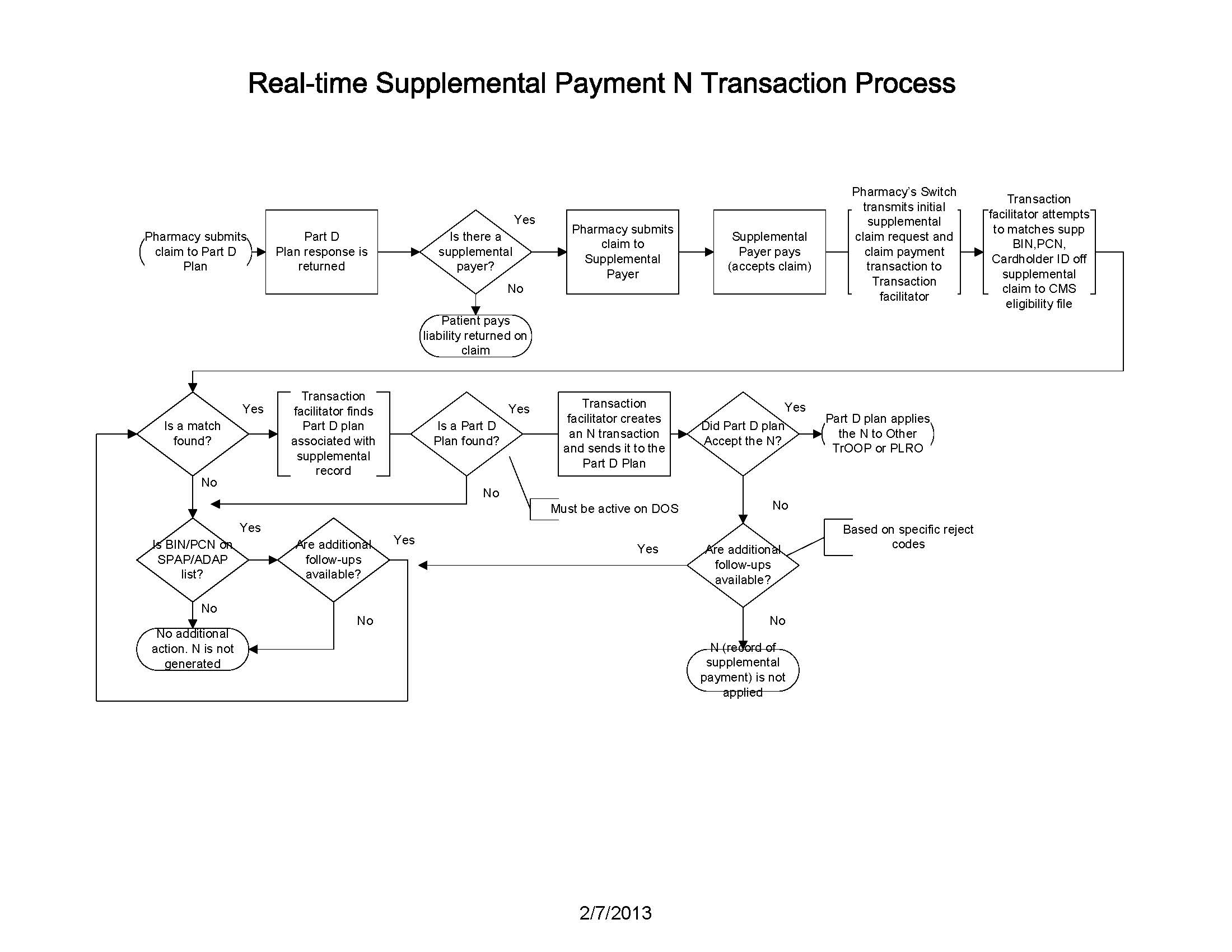

In a nutshell, the process of providing Part D Plans with a record of a Supplemental Payers coverage for purposes of coordination of benefits is documented in the high-level flow below:

This flowchart depicts the flow of a transaction starting with a claim that is submitted by the pharmacy to the supplemental payer. Once paid by the supplemental payer, the switch that routed the claim from the pharmacy to the supplemental payer forward a transaction with necessary information from the claim to the Transaction Facilitator. The Transaction Facilitator then identifies the beneficiary and their Part D plan by comparing the 4Rx (BIN, PCN, Cardholder ID and Group) from the supplemental claim to other health insurance information on the eligibility file from CMS. If a match is found, the Transaction Facilitator send the information of record of supplemental claim coverage to the Part D Plan. The Part D plan will then apply the amounts to either Other TrOOP or Patient Liability Reduction Due to Other Payer Amount (PLRO).